What Are the 4 Walls of a Budget?

4 Min Read | Oct 11, 2023

For over a decade, I’ve been teaching people all about budgeting—so you know I’ve been asked certain questions again and again. Honestly, a ton of those are about how to get started or what to do if you’re suddenly in crisis mode. Well, the answer to both of those questions comes down to covering the Four Walls.

What are the Four Walls? Let’s find out.

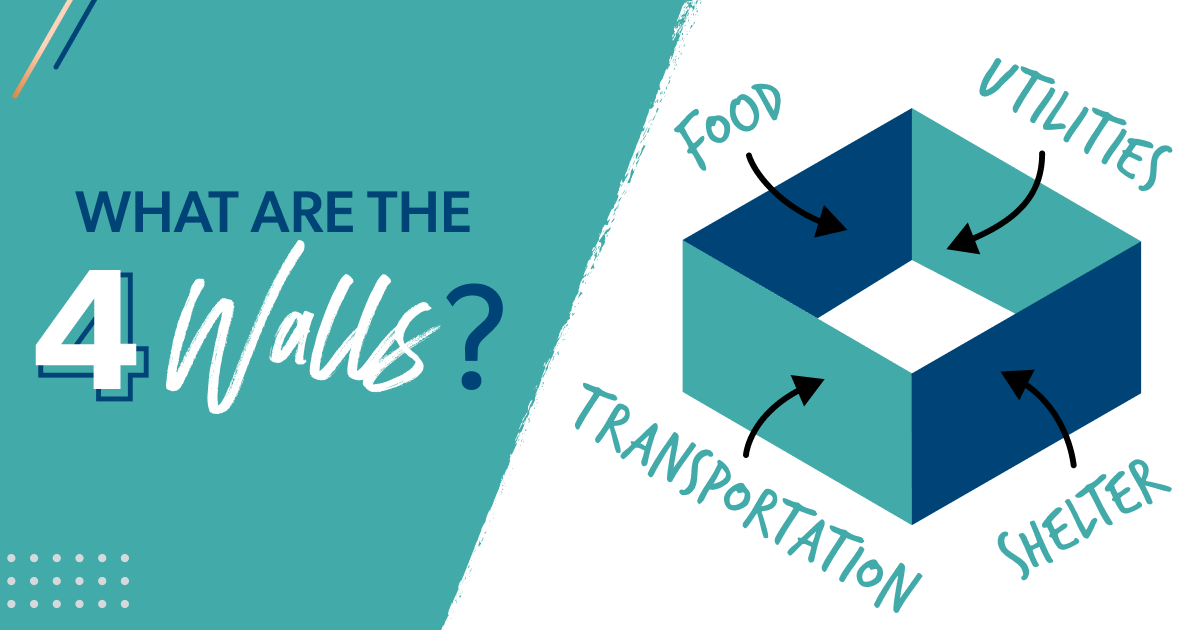

What Are the Four Walls of a Budget?

Simply put, the Four Walls are the most basic expenses you need to cover to keep your family going: That’s food, utilities, shelter and transportation.

Food

When I say food is one of the Four Walls, I need you to hear this loud and clear: Groceries are essential—restaurants are not. This is coming from someone who loves going out to eat and even grabbing some Chick-fil-A for the family on the way home. But that delicious chicken is a luxury. Going out to my favorite Mexican restaurant on date night with Winston is a luxury.

Make sure there’s room in the budget for groceries (and other needs) before you make room for the luxuries!

Utilities

Next up are utilities, aka the expenses that keep your house running. Here are some of the most common ones:

- Electricity

- Water

- Natural gas or propane

- Trash services

- Basic phone bill

One thing to note with utility bills is they often change from month to month. As you write in a planned amount, budget on the higher side. If the bill’s lower, you can throw the extra money at your current Baby Step (which is the proven plan for saving money, getting out of debt, and building true wealth).

Shelter

“Shelter” means paying for rent or your mortgage (plus insurance, property taxes and HOA fees). A good rule of thumb here is to make sure you don’t spend more than 25% of your take-home pay on this part of the budget. That helps you keep from turning one of your biggest blessings (your home) into a financial burden.

Transportation

The transportation budget category can include gas, public transportation, routine maintenance—whatever it costs for you to get where you need to go that month.

Inside the Four Walls, this wouldn’t include plane tickets to Disney. If you’re debt-free and want that dream vacation, save up money in a sinking fund each month and pay cash for that trip. But just like restaurants, Disney is not a necessity!

When Do I Use the Four Walls?

The short answer to that question is all the time. The Four Walls have a special place at the top of your monthly expenses in every monthly budget.

But unless you’re out there teaching budgeting like I do, you probably won’t be thinking about the Four Walls all the time. Here are the main two times when you should, though:

1. When you’re in a financial emergency

If you’re ever in an emergency situation (like job loss)—first off, remember, you will be okay.

Then get yourself on a bare bones budget, a making the Four Walls your top priority. That means you focus on feeding your family, keeping the lights on, paying the rent or mortgage, and getting gas in the car. This will help you keep afloat financially while you get back on your feet.

2. When you make a budget

The Four Walls help you set up your monthly budget. You start off your budget by listing your income. Then you make room for giving and saving (depending on what Baby Step you’re on). After that, you cover the expenses—starting with (you probably guessed it) the Four Walls!

Start budgeting with EveryDollar today!

Then comes in other necessities (like insurance, debt and childcare). And then the fun stuff (like personal spending, entertainment and restaurants).

When you think of the Four Walls as the start of all those expenses, it helps you sort out your needs versus your wants and keep your budget priorities in order.

You know what else can help? EveryDollar. This is the budgeting app my family uses every single month to make sure we’re covering our expenses and keeping our spending in line with all our money goals! You can start using EveryDollar. Today. For free.

So, get your free EveryDollar budget—and get your priorities in order. Literally.