If you’re anything like me, the last few years have taught you that having a solid money management plan is just as important as brushing your teeth (and if your dentist asks, yes, you absolutely floss daily). Think about it: You can’t even go to the grocery store without seeing the impact inflation has had on your favorite cereal. Not only that, but bills are going up and most of our paychecks are, well . . . staying the same.

If that stack of bills on the counter has been keeping you up more nights than you can count, it’s time to talk about money management: what it is, how to manage your money well, and what to avoid. Let’s jump in, folks.

What Is Money Management?

Money management is the process of managing your money through budgeting, tracking your expenses, paying your bills, saving and investing for the future.

The term money management might have you zoning out just like you did in Personal Finance 101. But now, it’s time to take it seriously. See, the key difference between living in your mom’s basement after college and owning your own place comes down to managing your money—successfully.

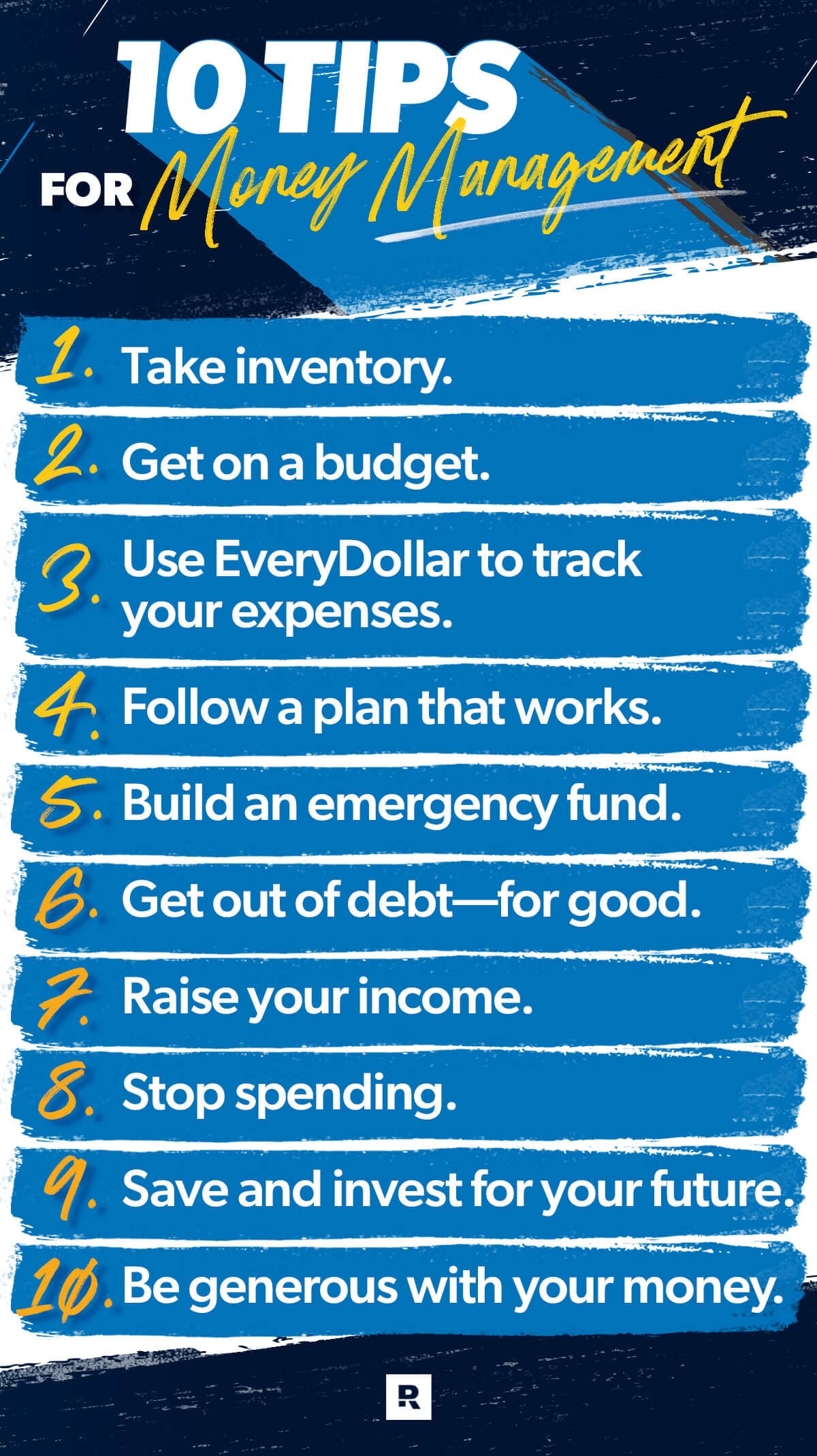

10 Tips to Managing Your Money Successfully

With 78% of Americans living paycheck to paycheck, it’s fair to say we could all use some money management tips to help us get back on track.1 So, what do you say we lose the financial stress and trade it for financial peace?

Check out these 10 tips that will help you do just that:

- Take inventory.

- Get on a budget.

- Use EveryDollar to track your expenses.

- Follow a plan that works.

- Build an emergency fund.

- Get out of debt—for good.

- Raise your income.

- Stop spending.

- Save and invest for your future.

- Be generous with your money.

Let’s break down each of these money management principles one by one so you can start managing your money like a pro.

1. Take inventory.

If you want to get serious about managing your money, you have to know what you’re dealing with. It’s time to take inventory, folks! Get out every unpaid bill, every recurring monthly (or quarterly or yearly) bill, all of your debts, credit cards, auto loans . . . everything. Leave no bill unturned. You want to know exactly what you’re paying for every single month and why.

Taking inventory helps you get a better handle on where your hard-earned money is going. It’ll also show you how much debt you have, how much income is coming in, and what expenses you have (including things like subscription plans you never even use).

2. Get on a budget.

If you’re not budgeting, you’re basically just winging it every month, just hoping there’s enough money to keep the lights on and food on the table. Believe me, that doesn’t fly very long!

Listen: A budget puts you in the driver’s seat of your money. A budget lets you—not the government, the credit card companies, or even your mother-in-law—decide how you’re going to spend your hard-earned money.

It’s time to get on a zero-based budget. What’s a zero-based budget, you ask? It’s where your income minus expenses equals zero. (That doesn’t mean you have zero in the bank. It just means you gave every single dollar a job to do . . . whether that’s giving, saving or spending!) And if you’re not budget savvy, don’t worry. There’s an app for that—it’s called EveryDollar. Download it for free, plug in your numbers, and track your expenses as you go. And speaking of tracking . . .

3. Track your expenses.

When it comes to budgeting, sitting down and doing the actual budget is only step one. Step two is a little something called tracking. Believe it or not, tracking your expenses is a just as important as doing the budget. If you just put some numbers down but never actually track what you’re spending throughout the month, how will you know if you’re staying on track? You won’t. Don’t let your overdrafted bank account be the only reason you know you’ve busted the budget.

Get Rachel Cruze's new book to learn why you handle money the way you do!

If you’re the pen-and-paper type of budgeter, tracking looks more like going through all your receipts one by one as you record what you spent in each budget category. If that’s you, more power to you. But as a modern millennial man, I barely own a pen—let alone paper. So, I stick to EveryDollar, which makes tracking even easier. Just add in your expenses as you spend, or upgrade to the premium version for a seamless tracking experience that lets you sync with your bank account. Then all you have to do is drag and drop. Boom. Tracking done.

4. Follow a plan that works.

To reach your financial goals—whether it’s getting out of debt, saving up for emergencies, investing for retirement, or all of the above—you need a plan with a clear path to success. Good news: I have just the money management plan for you—Dave Ramsey’s 7 Baby Steps.

The Baby Steps have helped thousands of people work their way out of debt and get on a path to building wealth (myself included). No matter where you are on your financial journey, this plan works:

- Baby Step 1: Save $1,000 for your starter emergency fund.

- Baby Step 2: Pay off all debt (except the house) using the debt snowball.

- Baby Step 3: Save 3–6 months of expenses in a fully funded emergency fund.

- Baby Step 4: Invest 15% of your household income in retirement.

- Baby Step 5: Save for your children’s college fund.

- Baby Step 6: Pay off your home early.

- Baby Step 7: Build wealth and give.

When you focus on one goal at a time, you’ll make real progress. Plus, when you follow the Baby Steps in order, you won’t fall into the debt trap again, because you’ll have your priorities in order.

If you’re thinking, This sounds so simple, you’re right. Personal finance is 80% behavior and only 20% head knowledge. Some of the most mind-blowing truths are simple to learn but hard to do. But when you have the right tools and the right plan, you’ll stay motivated to finish strong.

5. Build an emergency fund.

You may have heard of an emergency fund before. Some people call it a rainy-day fund, a disaster fund, or my personal favorite: an oopsie-daisy fund. But no matter what you call it, it’s crazy important to have one.

An emergency fund turns life’s major emergencies into minor inconveniences. If you’re in debt, start with an emergency fund of $1,000 (Baby Step 1). Over time, you’ll beef up your emergency fund to cover 3–6 months of expenses (Baby Step 3). But before you do that, you’ll need to tackle the biggest threat to your money management toolbox: debt.

6. Get out of debt—for good.

Debt is dumb. There, I said it. And I’ll say it again and again as many times as I need to. Debt. Is. Dumb. Decide right now that you’ll never use debt to manage your money again. Then kick it out of your life once and for all (and make sure it never comes back again). You might be wondering, But how do I kick debt out of my life for good, George? You’ll always have some debt. Nuh-uh.

Allow me to introduce you to my frosty friend, the debt snowball method. Here’s how it works: You list your debts from smallest to largest (don’t worry about interest rate). Then pay minimum payments on everything but the smallest one. You’ll throw all your extra cash from side hustles and garage sales at that debt until it’s paid off. Then you’ll roll what you were paying on it into the payment on your next-smallest debt. Keep going until you’re completely debt-free. Then get yourself to Franklin, Tennessee, for your debt-free scream!

More Money. Less Stress. Yes, Please.

In his new book, George Kamel does the research for you and exposes all the worst money traps out there so you can build real wealth!

7. Raise your income.

Want to speed up your debt snowball and fill up your emergency fund even faster? You’ve got three options: raise your income, cut some expenses, or do both for extra credit! No matter which one you do, it’ll feel like you got a raise.

There are a million ideas on how to raise your income and create margin with your money (to pay off debt faster): Have a garage sale. Deliver pizzas on nights and weekends. Cancel that gym membership you signed up for back in January but never use. Deliver groceries with InstaCart or Shipt. Cancel subscriptions you don’t use. Start a side hustle. I could keep going . . . There are plenty of ways to trim down your budget. All it takes is focus, hard work and the drive to kick up your money management game. I believe in you!

8. Stop spending.

Did I really just say that? Sure did. Okay, I’m not telling you to stop paying your bills. I’m just telling you to stop spending on the extras. Like I said earlier, one way to raise your income is to cut expenses. But another way to cut back is by cutting out the extra spending. You know, the nickel-and-diming we all do on an everyday basis.

Trade that fancy $6 latte for a home-brewed cup of coffee. Instead of grabbing those fun gadgets at the Target Dollar Spot, avoid that area of the store altogether (pretend that part of the floor is lava, if it helps). And instead of eating out at restaurants when you don’t feel like cooking, start preparing your meals in advance. That’s an easy way to save $30 just like that!

It will be hard at first, but as soon as you train your brain to stop spending at the drop of a hat, your wallet and your budget will see a huge difference. And when you see the margin and progress, it gets addictive, and you get more and more creative with other ways to sacrifice and save.

9. Save and invest for your future.

Alright folks, this is where the fun really begins.

While most people say investing for the future is one of their top financial goals, the truth is, we have some catching up to do. A research study by Ramsey Solutions found that about 4 out of every 10 Americans (42%) aren’t currently saving for retirement, and over half (56%) of Americans feel behind on their retirement savings goals.2 Yikes. We’ve got to do better, America!

No matter how much or how little you have in your nest egg, there’s still time to turn things around. Whether you’re 24 or 54, it’s never too early or too late to start! Retirement is coming. You need to prepare for your golden years now.

Here’s how you can make sure you’re saving enough for retirement and staying on track to reach your retirement goals:

- Invest 15% of your gross income into tax-favored retirement accounts like your 401(k) or a Roth IRA.

- Invest in good growth stock mutual funds.

- Work with a financial advisor.

The truth is that anyone in America can become a millionaire—including you! Dave’s new book, Baby Steps Millionaires, will show you exactly how millions of Americans used the Baby Steps to build wealth over time and become millionaires.

10. Be generous with your money.

There’s no denying the connection between those who win with money and those who are generous. The two go hand in hand like peanut butter and jelly.

People who are generous with their time and their money are attractive—and I’m not talking physically attractive. I mean, it’s possible that they are. But there’s no scientific correlation. I just mean they’re more likable. Studies have shown that being generous leads to more happiness, contentment and a better quality of life.3 Isn’t that the kind of person you want to be around? And the kind of person you want to become?

Don’t miss this: It’s not financial success that causes people to be generous. It’s being generous throughout their financial journey (even when it’s hard) that allows folks to win with money. Don’t wait until you have a certain amount of money in your bank account or time on your calendar before you start practicing generosity. Be intentional about making generosity a regular part of your life today.

What to Avoid When Managing Money

So, now that you have a good money management plan, let’s talk about three things to avoid that will ruin any and all progress:

- Debt: I talked about this one earlier. Avoid it like it’s lava—or spam (the edible kind or the email kind). Once you allow it into your life, it’s hard to get rid of it (not unlike spam). And anyone trying to sell you debt as a good way to manage your money is just straight up scamming you (and probably spamming you).

- Debt Management Plans (DMP): If you’re in the deep end and don’t know where to turn, do not turn to a DMP. You’ll just end up frustrated and paying more in fees than you will to your actual debt. Just don’t do it. Remember, we don’t want to “manage” debt—we want to get rid of it!

- Credit Cards: This is big. You may have been sucked into the lie those bigwigs at credit card companies have been feeding people for years, but don’t buy it. Credit cards are just another form of debt wrapped in shiny plastic. Don’t fall for the rewards game or the credit score game. Only spend what you have in your bank account (after you’ve budgeted, of course).

Get Help Managing Your Money

Are you ready to become the boss of your money but not quite sure where to begin? That’s okay! Nearly 10 million people have been in your shoes and decided to learn how to manage their money the right way with Financial Peace University (FPU). In nine lessons, you’ll learn how to dump debt, save for emergencies, invest for the future, and more.

Check it out here. You won’t regret it.